bradford tax institute erc

October 18 2022. Murray Bradford in 1991 Bradford Tax Institute is the.

Maximize Your Client S Employee Retention Tax Credits Erc Ppp Forgiveness

If you didnt cheer up.

. Bradford Tax Institute Blog. BBB records show a license number of A140235 for this business issued by California Tax Education Council. And thanks to the latest new law the American Rescue Plan Act of 2021 ARPA the already enhanced 2021 ERC is extended for an additional six months through December.

Covid tax credits employee retention credit erc paycheck protection program ppp ppp forgivable loan. You understand that the Bradford Tax Institute web site and the Tax Reduction Letter are generalized publications are not rendering legal accounting or other professional advice. Answers to 12 Employee Retention Credit ERC Questions.

What Bradford Tax Institute customers think NEW. Bradford Tax Institute provides proven tax reduction strategies for one-owner and husband-and-wife-owned businesses. 1050 Northgate Drive Suite 351 San Rafael CA 94903.

So far no complaints. Responsiveness to problems or complaints. The new IRS Notice 2021-49 disallows the valuable employees tax credit ERC to more-than-50 owners owners who have certain living relatives.

Bradford and Company Inc. Is the market leader and expert in tax reduction seminars and products for the self-employed business owners. Bradford tax institute subscription services 1050 northgate dr ste.

Responsiveness to problems or complaints. I received my ERC. Quality of products or services.

California Tax Education Council. Since 1989 Bradford and Company has. Bradford Tax Institute Subscription Services 1050 Northgate Dr Ste.

These agencies may include.

Bradford Tax Institute Facebook

Act Now Claim Your 2020 And 2021 Employee Retention Credit Erc

Covid 19 Archives The National Cannabis Industry Association

Bradford Tax Institute Facebook

Bradford Tax Institute Facebook

Bradford Tax Institute Facebook

Maximize Your Client S Employee Retention Tax Credits Erc Ppp Forgiveness

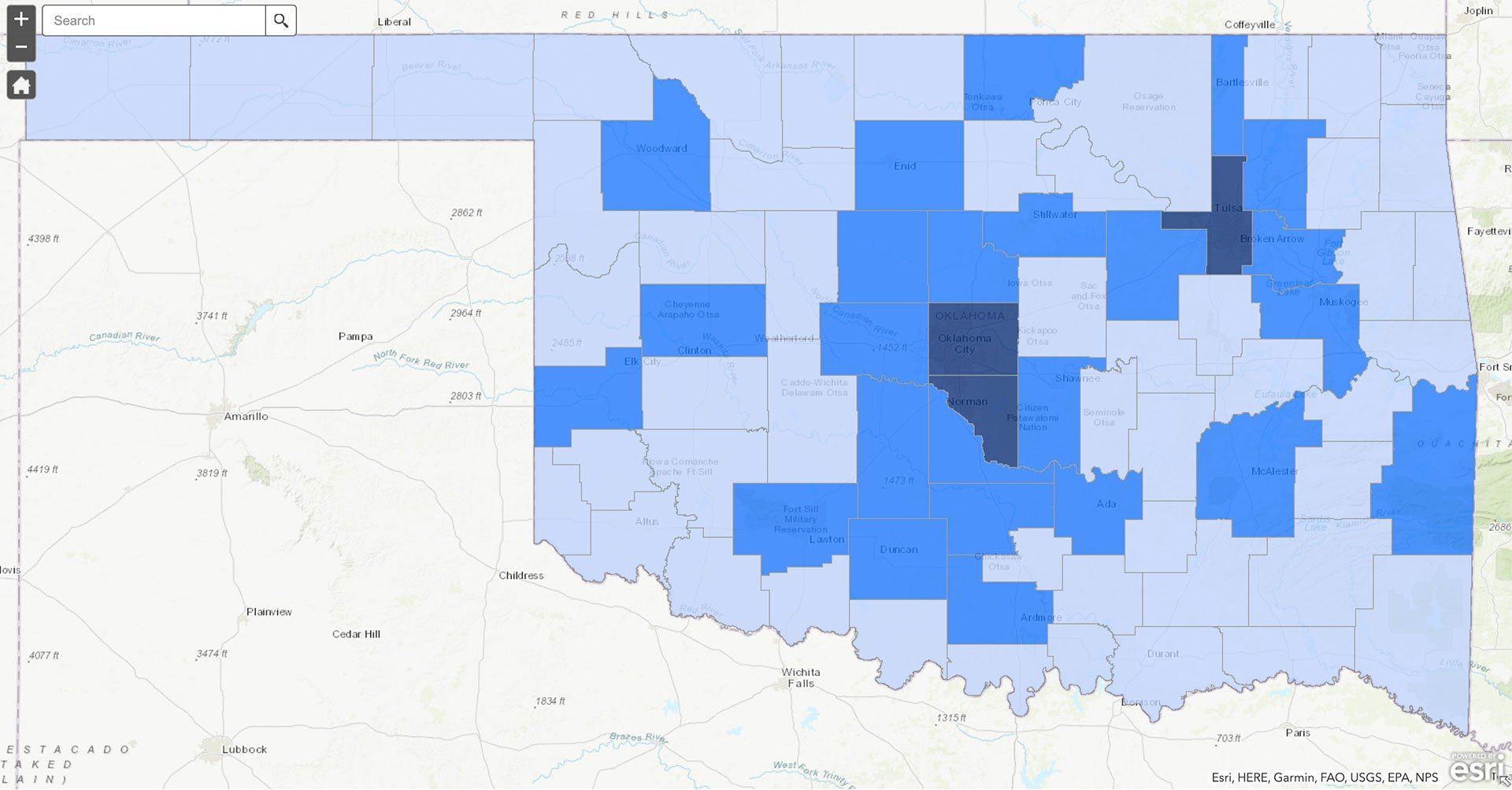

Oklahoma Business Relief Program Reporting Oklahoma Department Of Commerce

Employee Retention Credit Estimate Claim Your Erc Credit

Money Talks The Blog Of Morris D Angelo Not Just Another Cpa Firm Morris D Angelo

New Stimulus Law Grants Eight Tax Breaks For 1040 Filers

Maximize Your Client S Employee Retention Tax Credits Erc Ppp Forgiveness

A Guide To Claiming The Employee Retention Tax Credit Nada

Thomas A Gorczynski Ea Ctp Ustcp Senior Tax Consultant Gorczynski Associates Llc Linkedin

Maximize Your Client S Employee Retention Tax Credits Erc Ppp Forgiveness

Maximize Your Client S Employee Retention Tax Credits Erc Ppp Forgiveness